Symlearning is now live & open for registrations!

Symlearning is part of Sympac’s commitment to provide customers with the highest level of product, service, and support now and

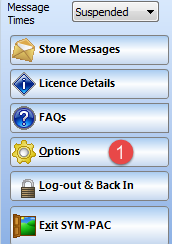

Click OPTIONS on the sympac desktop

Click UPDATES

Then click PROGRAM UPDATES VIA THE INTERNET

Once the update has completed go to Updating Payroll Tax Scales below.

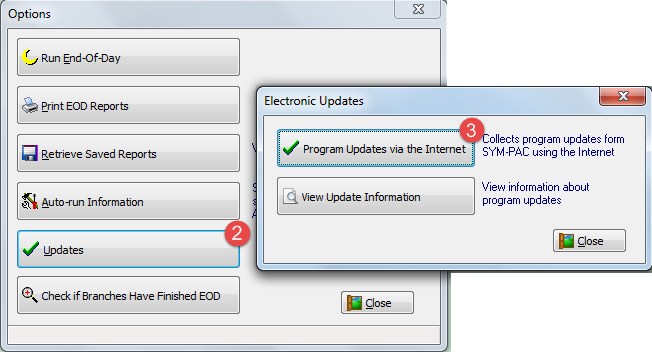

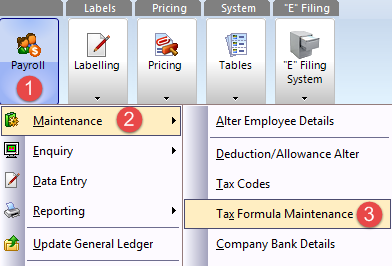

Click PAYROLL on the sympac desktop menu.

Then click MAINTENANCE

Then TAX FORMULA MAINTENANCE.

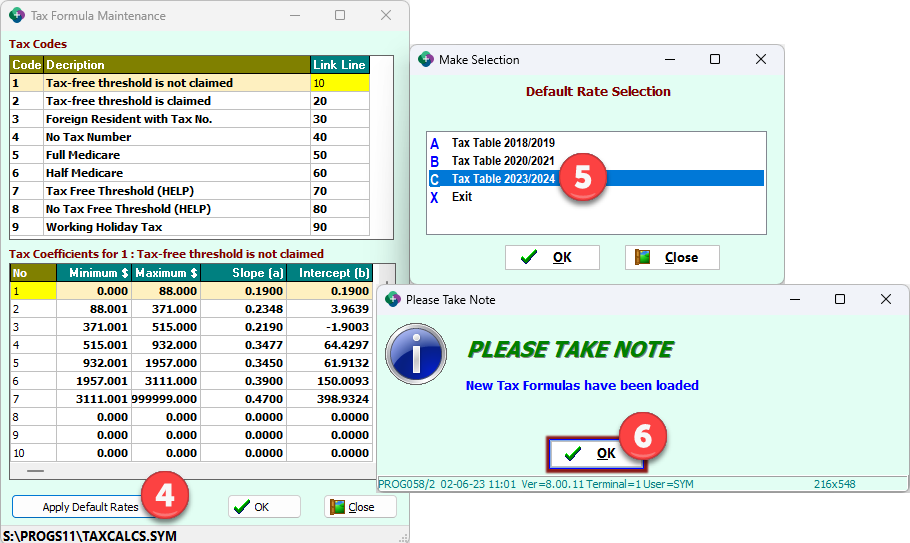

Click APPLY DEFAULT RATES.

Then select Tax Table 2023/2024 and click OK.

The new tax formulas have now been successfully applied!

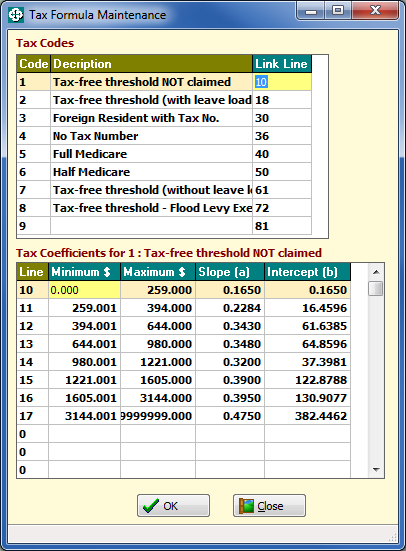

To alter an existing tax formula or insert a new one select Payroll, File Maintenance and then Tax Formula Maintenance.

The top half of the screen shows the Tax Codes and their descriptions, the bottom half of the screen displays the Tax Coefficients (the formula) for each Tax Code set up. The Link Line is the first line number of the formula for that appropriate tax scale. Most tax code formulas include multiple calculation lines for each code because the rate usually changes as the dollar amount increases.

The formulas can be inserted or altered by the following:

Minimum $ Value: The gross earnings that the rate starts or begins.

Maximum $ Value: The gross earnings that the rate ends or changes.

Slope and Intercept: The tax department calculates the formula through a linear equation in the form of y = ax – b, where y is the tax amount in dollars and x is the gross earnings. The slope and intercept are the values of the coefficients a & b for the formula given by the tax department.

The tax formulas can be maintained by the user and tailored to suit any tax situation. However it is recommended that you do not delete tax formulas that already exist, but rather add new ones as needed.

For further information on the Tax Scales used within Sympac, please visit the ATO links below:

If you require further assistance with the above please contact the Sympac Client Services team on 1300 361 732 or email [email protected].

Our Client Services Team are available from 7am to 8pm EST to assist you.

Symlearning is part of Sympac’s commitment to provide customers with the highest level of product, service, and support now and

Key updates in this release include updates and improvements to POS, Debtors, Inventory as well as Payroll and Creditor updates.

As part of a recent software release, a system setting to purge completed Purchase Orders at the End of Month

Subscribe to our News Blog to get alerts when we release new software updates, features & enhancements.

That’s great! Your suggestions and feedback about our systems helps us continually refine and enhance our offering and services.

Timber Groups Set Up

How to Set Up Timber Grouped Products in Detail ...

Timber Group Products Point of Sale Processing

How to Process Timber Grouped Products in POS. POS will split out the lines for Products in the group on the POS Screen, mainly used for Timber Product were sell prices may be different based on length ...

Timber Groups Introduction Overview

Walk through on how Timber Grouped Products are Set Up and Processed in POS ...

How to Set Up Customer By Product and FLC Discounts INVPD 112

How to Set Up Customer by Product or FLC Discounts ...